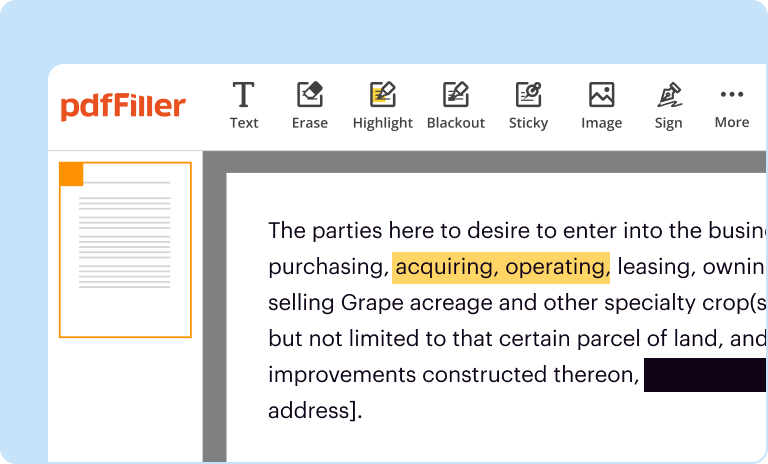

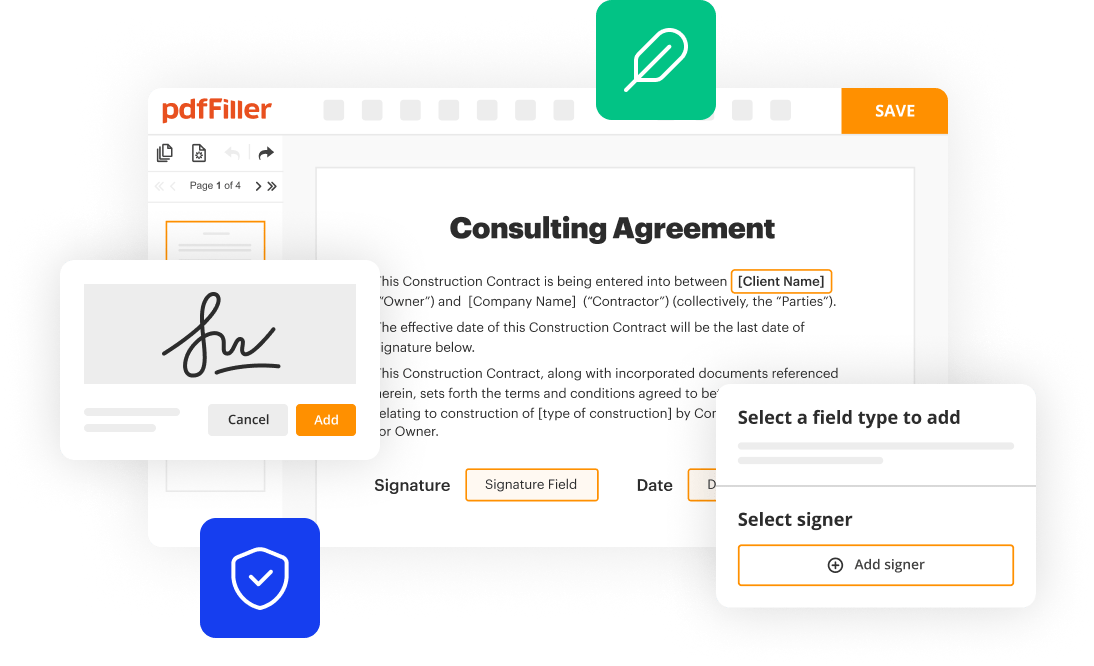

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

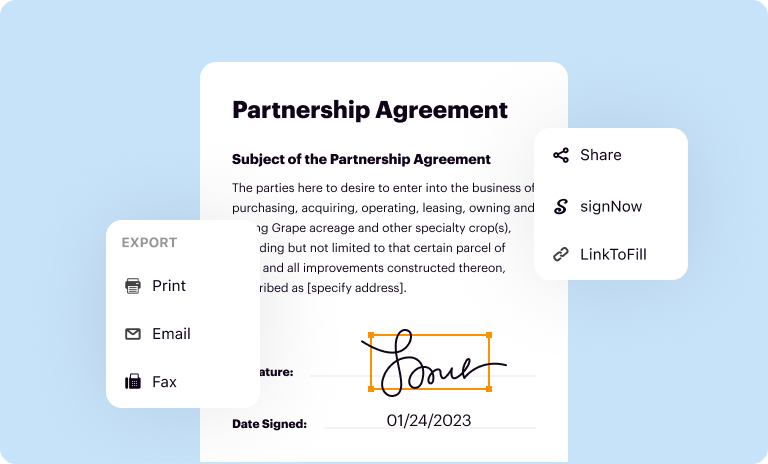

Email, fax, or share your direct deposit authorization form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

Edit direct deposit authorization form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

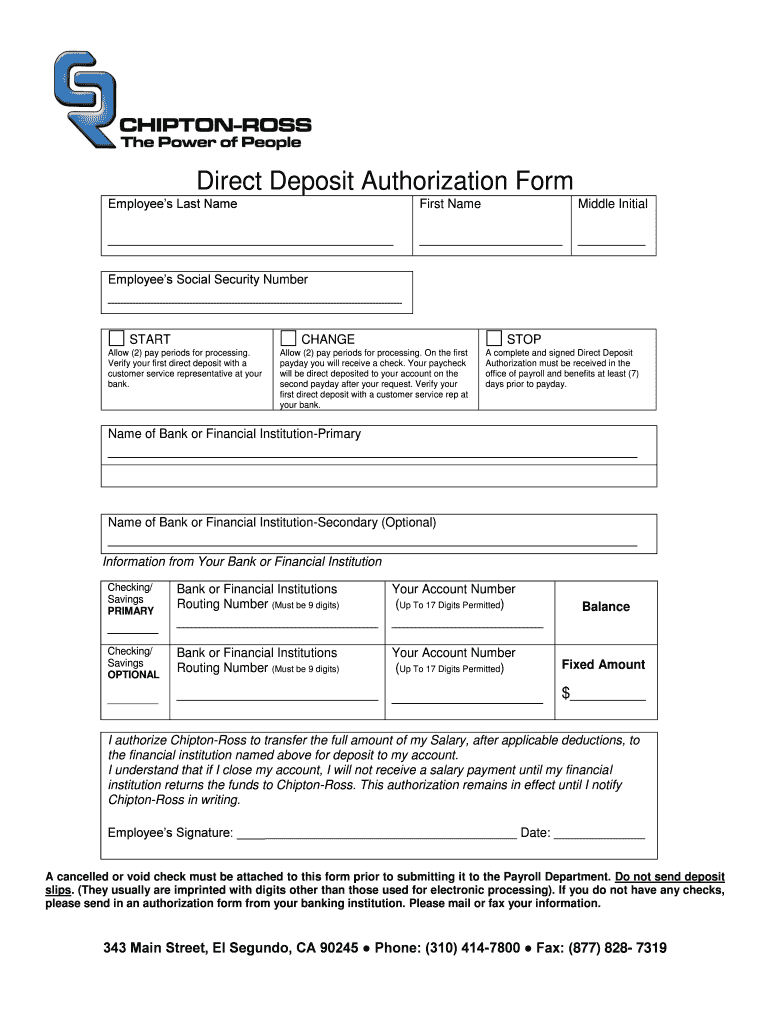

Obtain the direct deposit authorization form from your employer or financial institution. This form is typically required when setting up direct deposit for your paycheck or other recurring payments.

Fill in your personal information, including your full name, address, and contact information. Make sure to double-check for any errors or missing information.

Provide your bank account details, including the bank name, routing number, and your account number. It is important to accurately input these numbers to ensure the funds are deposited correctly.

Indicate the type of account the funds should be deposited into, such as checking or savings.Choose the desired start date for the direct deposit. This is the date when the first deposit will be made into your account.

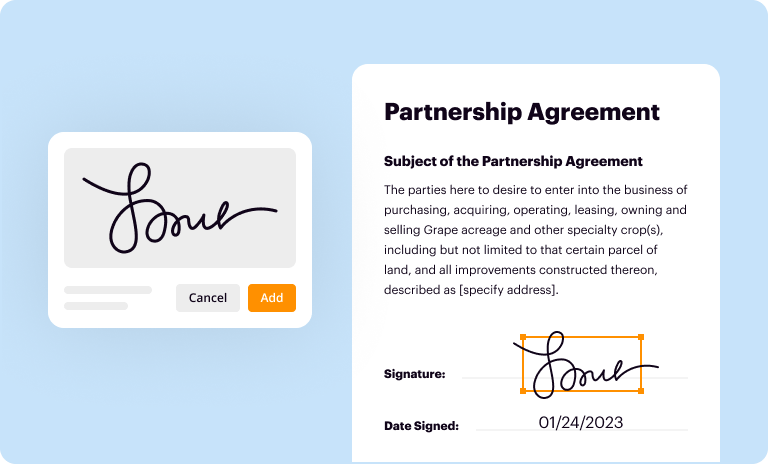

Review the form for accuracy and completeness. If everything looks correct, sign and date the form.Submit the form to your employer or financial institution as instructed. They may require additional documentation or signatures, so be sure to follow their specific instructions.

Employees: Many employers require their employees to complete a direct deposit authorization form to facilitate timely and secure payment of their wages. Employees who want to receive their paycheck electronically instead of receiving a physical check will need to fill out this form.

Individuals receiving recurring payments: Direct deposit authorization forms are also commonly used by individuals who receive regular payments, such as Social Security benefits, pensions, or dividends. These individuals may need to provide their banking information to the paying organization or government agency to receive the payments via direct deposit.

Individuals making automatic payments: Some individuals may also need to fill out a direct deposit authorization form to enable automatic payments for their bills or services. This form allows the service provider or biller to withdraw funds directly from the individual's bank account, making bill payment more convenient and efficient.